Mortgage Funder Q&A

Most frequent questions and answers

You can Register to be a Mortgage Funder through the platform.

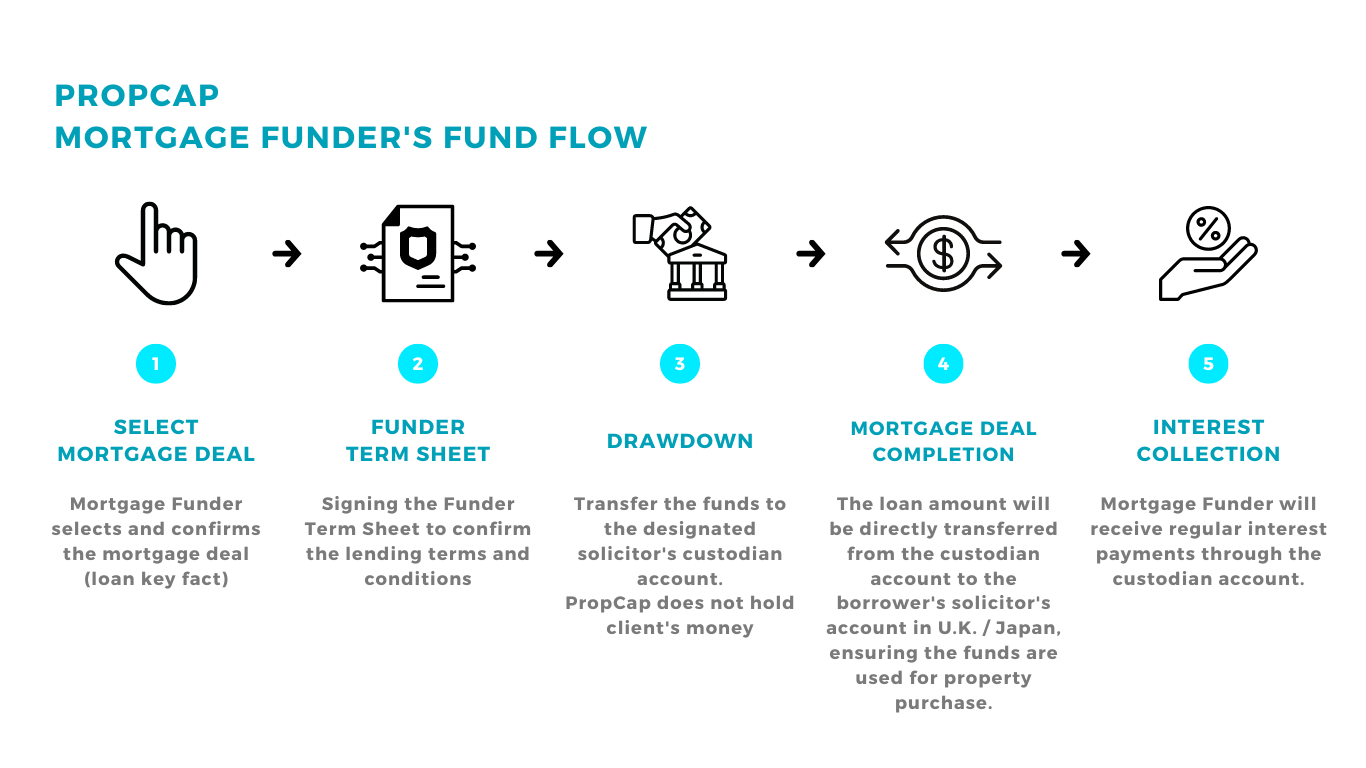

It is not a fund. Propcap does not hold client’s money.

Yes, you can specify your lending currency. If the currency matches your preference, a potential mortgage deal will be presented to you upfront.

Yes, the mortgage funder chooses its own mortgage deal through the platform.

No, all lending transactions are One Mortgage Funder finances to One Borrower.

- Photo of current Identity Proof

- Selfie

- Residential Address Proof (Utility bill / Credit card statement / Bank statement)

- Source of Funds

- Source of Wealth

- The lender writes to the borrower to demand payment of arrears.

- If the borrower failed to repay, we shall send a pre-action letter to the borrower and demand payment in 2 weeks.

- After 2 weeks, we shall issue a claim form and start court action against the borrower and apply for a court procession order.

- The borrower has a time frame to file a defence or settle the payment.

- If no payment is received or the borrower did not file a defence, we shall apply to the court for a hearing date.

- We shall instruct a barrister to attend the hearing.

- If the judge granted a procession order, the borrower must vacate the property and hand over the keys to PropCap for handling. If not, we shall instruct a bailiff to re-possess the property.