For many Hong Kong residents, owning property is a lifelong goal. However, in Japan, housing trends are evolving in a different direction. According to the latest Reiwa 5 (2023) Comprehensive Housing and Living Survey published by Japan’s Ministry of Land, Infrastructure, Transport, and Tourism (MLIT), the desire for homeownership has declined over the past five years, and demand for newly built homes has weakened. Instead, renting is becoming an increasingly popular choice, reflecting a shift in how Japanese people view housing.

Japan’s Ageing Population and Economic Factors Influence Housing Choices

The Housing and Land Survey, which analysed 72,421 households across Japan, highlights the country’s deepening ageing population crisis. The survey found that 47.3% of the population is aged 65 or older, making elderly individuals the dominant demographic. Meanwhile, the 40-49 age group accounts for 12.6%, and those under 30 make up only 4.5%. As Japan’s society continues to age, demand for homeownership is naturally declining, as older adults are more likely to remain in their existing residences rather than relocate or purchase new properties. Many retirees prefer housing stability over long-term financial commitments, which further suppresses the demand for newly built homes.

In addition to demographic shifts, household income levels play a crucial role in shaping housing preferences. The vast majority of households range from 2 million to 10 million yen annually. The survey found that 16.5% of households earn between 2 million and 3 million yen per year, making this the most common income bracket. Additionally, 14.9% earn between 5 million and 7 million yen, while 14.7% fall within the 3 million to 4 million yen range.

With rising property prices and stagnant wage growth, many Japanese citizens find renting to be a more practical and financially manageable option. Homeownership often involves long-term mortgage commitments, which may not align with the financial goals of middle-income households. As a result, more people are opting for rental housing to reduce financial pressure and maintain greater flexibility in their living arrangements.

Shifting Trends: Homeownership vs. Renting in Japan

While 70% of respondents own property, with 60% living in detached houses, the number of renters has steadily increased to 30%. This suggests that, although many still prefer homeownership, the younger generation is increasingly choosing renting over buying, mainly due to financial flexibility and lifestyle preferences.

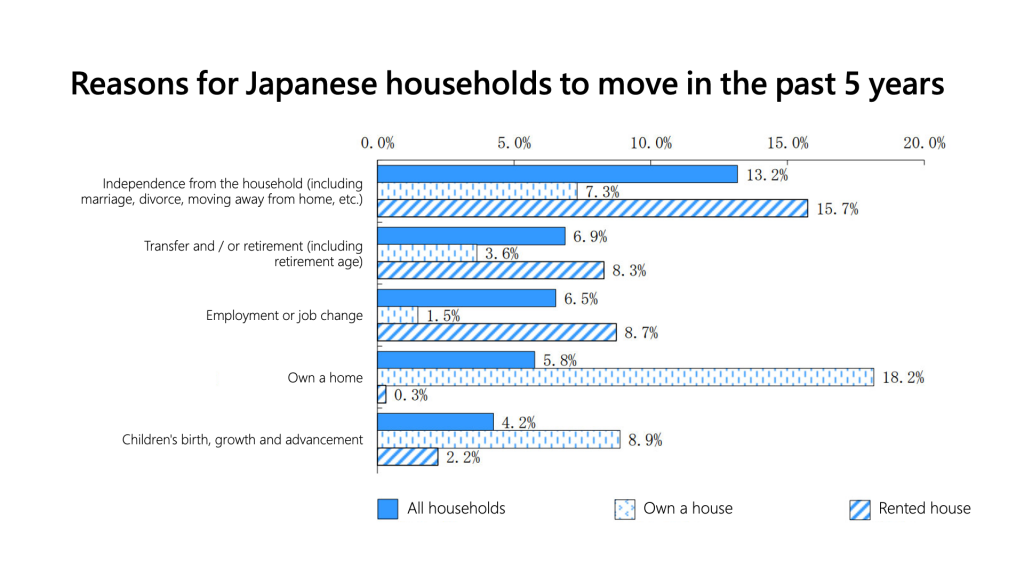

Survey results indicate that the primary reasons for moving in the past five years include leaving the family home, such as for marriage, divorce, or independent living, which accounted for 13.2% of relocations. Additionally, 6.9% moved due to job transfers or retirement, while 6.5% relocated due to employment changes or financial adjustments. These figures reveal that work and financial stability significantly influence Japanese housing choices. Many individuals who frequently change jobs or relocate for work prefer to rent rather than commit to a long-term mortgage.

Meanwhile, those who chose to buy a home did so primarily due to the desire for homeownership (8.2%) or family-related reasons, such as having children or education needs (8.9%). While homeownership remains important for stability-seeking families, the overall enthusiasm for purchasing property has declined compared to previous years.

Future Housing Preferences: Will More Japanese Rent or Buy?

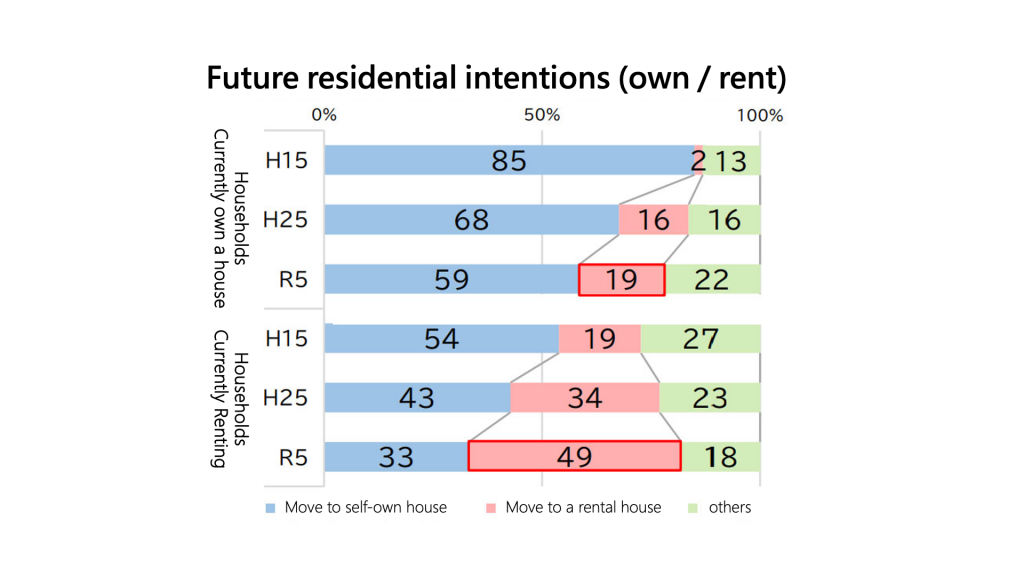

When asked about future housing decisions, fewer respondents expressed a preference for homeownership. Among current homeowners, only 59% stated they would choose to buy again if they moved, down from 68% in the previous survey. Meanwhile, 49% of renters said they would continue renting, signalling a growing shift toward rental living.

This change in mindset may be linked to rising property prices, making homeownership less attractive. With housing costs increasing, many Japanese now see renting as a more practical and affordable option. This shift suggests that demand for rental properties in Japan will continue to grow in the coming years.

Newly Built vs. Second-Hand Homes: What Do Buyers Prefer?

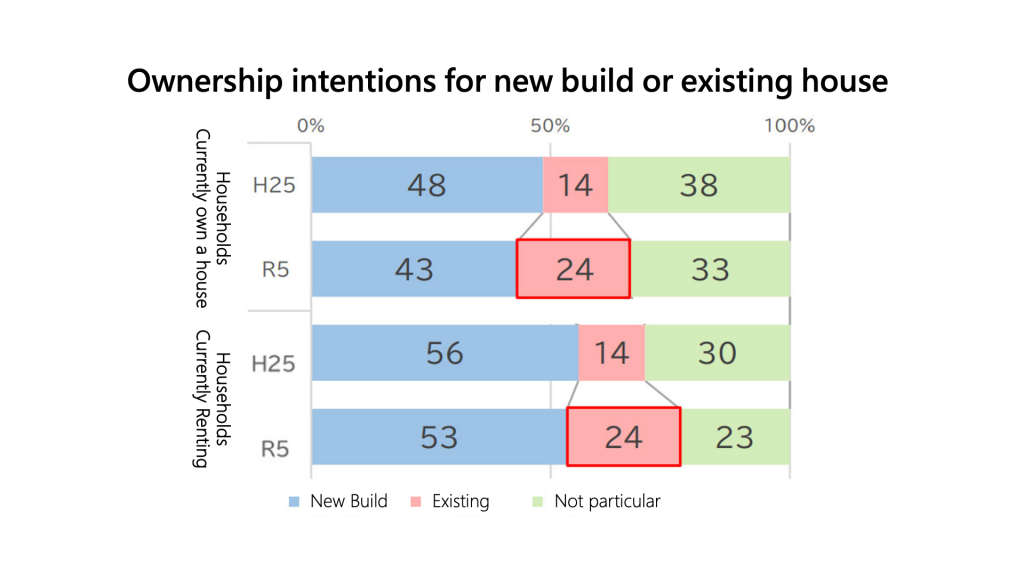

Traditionally, Japanese homebuyers have favoured newly built properties. However, survey results indicate a growing willingness to consider second-hand homes.

This shift is likely due to the higher availability of second-hand properties, making it easier for buyers to find a suitable home. Additionally, second-hand homes are generally more affordable, appealing to buyers who seek cost-effective options in an increasingly expensive market.

For renters, the rising cost of new apartments has also led to greater interest in pre-owned rental properties, especially in major cities where rental prices remain high.

Location Remains the Top Priority for Japanese Homebuyers

Regardless of whether they buy or rent, location remains the most critical factor for Japanese residents when choosing a home.

Survey data shows that 55.7% of homebuyers prioritise location above all else, ranking it significantly higher than price, size, or layout. By contrast, only 16.9% of respondents consider property size and layout as the second most important factor.

This finding highlights that proximity to key amenities, transportation, and lifestyle conveniences outweigh other considerations. Even among renters, living in a well-connected and desirable area is a top priority, emphasising the importance of high-demand locations in Japan’s real estate market.

The Rising Demand for Rentals and Japan’s Changing Housing Market

The latest survey results reveal a structural shift in Japan’s housing market, with declining homeownership interest and a growing preference for renting. Factors such as an ageing population, financial constraints, and high work mobility contribute to this trend. Additionally, as property prices continue to rise, many Japanese citizens see renting as a more flexible and financially viable option.

The increasing demand for rental housing presents new opportunities for investors. As more people choose to rent, the Japanese rental market is expected to expand, offering the potential for stable investment returns. Meanwhile, the growing interest in second-hand properties suggests a shift in buyer behaviour, with affordability and availability driving purchasing decisions.

Looking ahead, as Japan’s rental population grows, the real estate sector will likely continue shifting towards a stronger focus on rental properties. High-demand locations will remain attractive for both buyers and renters, and investors should monitor this trend to capitalize on emerging opportunities in the Japanese housing market.