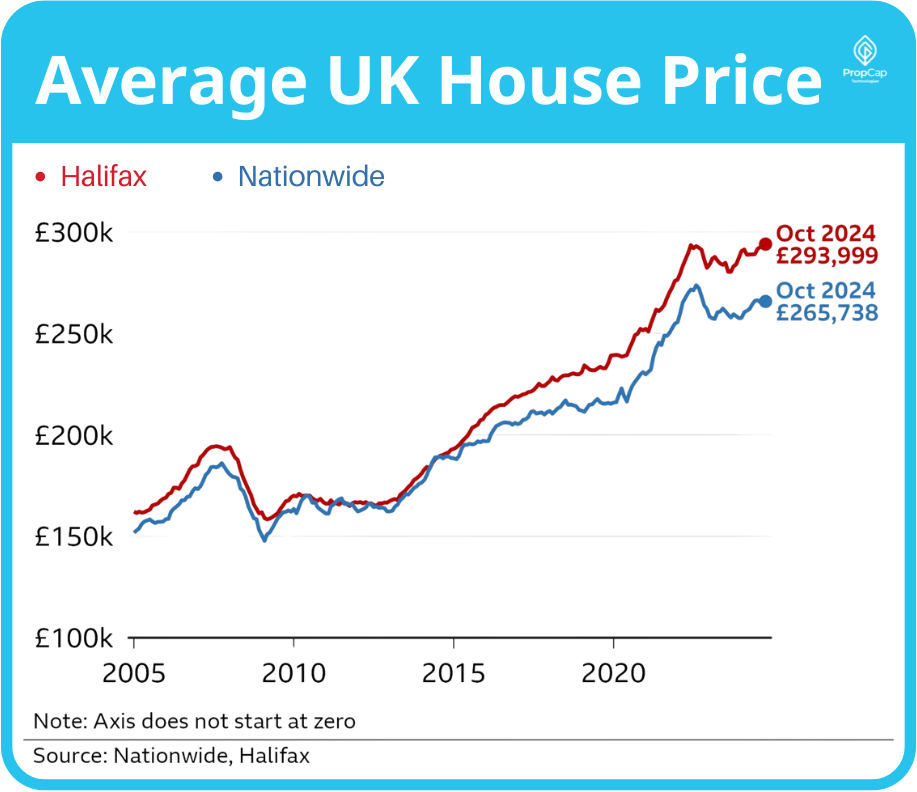

The average UK house price reached an all-time high of £293,999 in October, surpassing the previous peak of £293,507 recorded in June 2022, according to Halifax, the UK’s largest mortgage lender.

Halifax expects house prices to continue rising at a “modest pace” in the coming months. However, following last week’s Budget announcement, mortgage costs may remain elevated for a longer period, adding pressure on potential buyers.

UK Interest Rate Adjustments and Market Outlook

The Bank of England recently reduced its base rate from 5% to 4.75%, but the pace of future rate cuts is expected to slow. Bank Governor Andrew Bailey remarked that while rates will gradually decline, the reductions must be measured to maintain inflation near the 2% target. “We can’t cut interest rates too quickly or by too much,” he cautioned.

House prices have now risen for four consecutive months, with a 0.2% increase in October. On an annual basis, prices are up by 3.9%, slightly lower than September’s 4.6% increase, but the market remains stable overall.

Mortgage Trends and Market Activity

Halifax commented “That house prices have reached these heights again in the current economic climate may come as a surprise to many, but perhaps more noteworthy is that they didn’t fall very far in the first place.” Despite the challenges of higher interest rates, property values have largely leveled off over the past two and a half years, with a modest total increase of 0.2%.

She also noted that recent Budget measures, including higher stamp duty for second-home buyers and a rollback of tax breaks for first-time buyers, might dampen some property demand. However, market activity is improving, with new mortgage approvals reaching a two-year high.

Currently, no stamp duty is charged on properties under £250,000, a threshold doubled from £125,000 in September 2022 under the mini-Budget. For first-time buyers, the exemption applies to homes worth up to £425,000, increased from £300,000. These elevated thresholds will revert to previous levels in March 2025.

David Stirling, an independent financial adviser at Mint Mortgages & Protection, remarked: “Estate agents are busy even in a higher interest rate environment, and mortgage applications and approvals remain robust.”

Where Are Prices Rising the Fastest?

Despite economic uncertainties and higher interest rates, the UK housing market continues to show resilience, with record-high prices and sustained buyer activity.

- London: The most expensive area in the UK, with an average price of £543,308, up 3.5% from last year.

- Northern Ireland: Leads in annual house price growth, with an average price of £204,242.

- North West England: The fastest-growing region in England, where prices rose by 5.9%, bringing the average house price to £235,587.

- Wales: Strong growth of 5.6% year-on-year, with average house prices at £225,543.

- Scotland: Average property prices reached £206,480, up 1.9% from 2023.