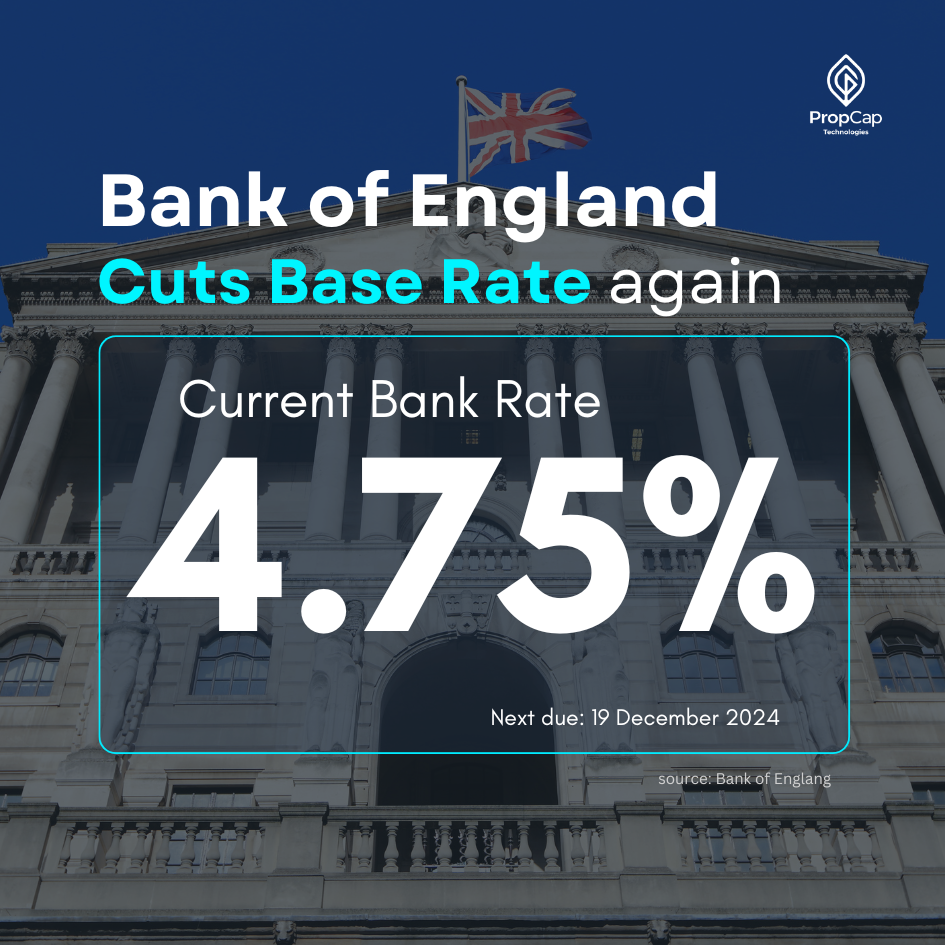

The Bank of England (BoE) has announced a 0.25% rate cut, lowering the base rate from 5% to 4.75%. This marks the second rate cut by the BoE this year.

The decision was influenced by October’s inflation rate of 1.7%, which came in below the forecasted 2%, indicating that inflationary pressures are easing. As a result, the Bank of England’s Monetary Policy Committee voted 8-1 in favour of another rate cut. Bank of England Governor Andrew Bailey remarked on the need to ensure inflation stays close to target levels, stressing that rate cuts should not be too rapid or excessive. However, if the economy develops as expected, the Bank plans to proceed with gradual rate cuts.

What Has Happened to Mortgage Rates Recently?

In recent weeks, mortgage lenders have responded with mixed actions—some have raised their mortgage rates, while others have reduced theirs. This latest Base Rate adjustment follows a series of significant macroeconomic and political events across both the UK and the US. Markets have already factored in a slower pace of Base Rate cuts, so in the short term, average mortgage rates might see a slight uptick before starting to decline again.

Today’s rate cut will likely ease the pressure on lenders to raise rates, which had begun to appear in recent weeks. The UK mortgage market remains competitive, but as recent developments suggest, rates will continue to be influenced by both domestic and international events.

The Base Rate Forecast for 2025

After the first Base Rate reduction in August, markets forecasted two more cuts by the end of 2024. However, due to other global factors beyond the Bank’s control, this has now been revised to a single cut, which was made today. Therefore, another rate cut this year is unlikely.

While we’re now beginning to see the start of a downward rate trend, it’s highly unlikely that rates will return to the historic lows we saw back in 2021. Looking ahead, the Base Rate might fall to around 4% by 2025, which would mean an estimated three additional cuts over the next year. Yet, as always, this will depend on broader economic factors and may shift based on evolving conditions.

If you’re exploring the best UK mortgage solution, especially in light of these recent changes, feel free to reach out to us. Our team is ready to guide you through the latest trends and help you find the perfect mortgage solution.